The concept represents the accounting value of an asset after accumulated depreciation or amortization has been subtracted from its original cost. For instance, a machine initially purchased for $100,000 with $30,000 in accumulated depreciation would have a value of $70,000. This calculation provides a snapshot of the asset’s current worth on the company’s balance sheet.

This calculation is a key financial metric used for assessing a company’s financial health and investment potential. It helps investors and analysts understand the true value of a company’s assets and make informed decisions about whether to invest in or acquire the company. Historically, this figure has been used to gauge the efficiency of a company’s asset management and its ability to generate returns from its investments.

The following sections will detail the individual components required for the calculation, explain the process step-by-step, and address common scenarios encountered in its application.

Guidance for Determining Asset Accounting Value

The following tips provide practical guidance to ensure accuracy and consistency when establishing an asset’s worth on a company’s financial records.

Tip 1: Ensure accurate tracking of original acquisition cost. This is the foundational element, and any error here will cascade through subsequent calculations.

Tip 2: Employ a consistent depreciation method across similar asset classes. Consistency promotes comparability and reduces the potential for accounting errors.

Tip 3: Regularly review depreciation schedules. Market conditions or technological advancements may necessitate adjustments to the estimated useful life of an asset.

Tip 4: Document all depreciation and amortization entries thoroughly. Maintain detailed records to support calculations and facilitate audits.

Tip 5: Consider salvage value. Even at the end of its useful life, an asset may retain some residual worth, which affects the total depreciable amount.

Tip 6: Understand the difference between depreciation and impairment. If an asset’s value declines significantly below its accounting value due to unforeseen circumstances, impairment may need to be recognized.

Tip 7: Be aware of industry-specific depreciation practices. Certain industries may have unique regulations or standards for depreciation accounting.

Accurate assessment is critical for sound financial reporting and decision-making. Following these tips will contribute to reliable financial statements and a clear understanding of a company’s asset base.

The final section will offer a summary of the key concepts covered.

1. Original Cost

The foundation for establishing an asset’s accounting value hinges directly on its initial acquisition price, often referred to as original cost. This figure represents the total expenditure incurred to bring the asset to its intended location and condition for use. Its accurate determination is paramount, as it dictates the subsequent depreciation schedule and, consequently, the asset’s accounting value over its lifespan.

- Defining Acquisition Price

Acquisition price includes not only the purchase price but also ancillary costs such as freight, installation charges, sales taxes, and any direct expenses necessary to prepare the asset for its intended use. For example, the original cost of a machine includes the price paid to the vendor plus the cost of transporting it to the factory and the expenses associated with its installation. Failure to include these associated costs understates the original cost and distorts the accounting value.

- Impact on Depreciation Calculation

Original cost serves as the basis for calculating depreciation expense. Whether using straight-line, declining balance, or units of production methods, the original cost is the starting point for determining the annual depreciation charge. An inflated or deflated original cost directly impacts the annual depreciation expense, ultimately affecting the reported accounting value.

- Consistency in Cost Determination

Consistent application of accounting principles in determining original cost is crucial. Organizations must adhere to established accounting standards and consistently apply them across similar asset classes. For instance, if capitalization policies dictate that certain repair costs are added to the original cost of an asset, this policy should be applied uniformly to all assets within that category. Inconsistent application can lead to misstatements of financial performance and asset values.

The precise and consistent determination of original cost is inextricably linked to accurately assessing an asset’s accounting value. By understanding its influence on the depreciation process and ensuring consistent application of accounting policies, organizations can present a more transparent and reliable view of their financial position.

2. Accumulated Depreciation

Understanding the process requires a thorough grasp of “accumulated depreciation,” the total depreciation recognized on an asset since its acquisition. This figure directly reduces an asset’s original cost on the balance sheet, leading to its accounting value. Accurate tracking of accumulated depreciation is essential for reliable financial reporting.

- Depreciation Methods and their Impact

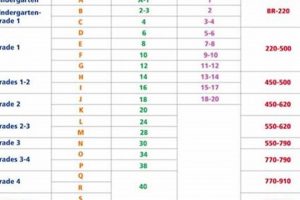

Various depreciation methods, such as straight-line, declining balance, and units of production, each yield different accumulated depreciation amounts over an asset’s life. The method selected significantly influences the accounting value calculation at any given point. For instance, the declining balance method results in higher depreciation expense in earlier years, thus a lower accounting value compared to the straight-line method during the same period. The chosen method should reflect the asset’s consumption pattern and must be consistently applied.

- Tracking Depreciation Entries

Each period’s depreciation expense is recorded as an increase in accumulated depreciation and a corresponding expense on the income statement. Meticulous tracking of these entries is crucial. Errors in depreciation expense calculations or incorrect recording will directly affect the accuracy of accumulated depreciation and, consequently, the accounting value reported on the balance sheet. Regular reconciliation of depreciation schedules with the general ledger is necessary to identify and correct any discrepancies.

- Adjustments to Accumulated Depreciation

Changes in an asset’s estimated useful life or salvage value require adjustments to the depreciation schedule. These revisions impact the future depreciation expense and, therefore, the accumulated depreciation balance. For example, if an asset’s estimated useful life is extended, the remaining depreciable base will be spread over a longer period, resulting in lower annual depreciation expense and a slower increase in accumulated depreciation. Proper documentation and justification for these adjustments are essential.

- Impact of Asset Disposal

When an asset is sold or disposed of, the accumulated depreciation associated with that asset is removed from the balance sheet. The difference between the asset’s original cost less accumulated depreciation (its accounting value) and the proceeds from the sale determines the gain or loss on disposal. Incorrect accumulated depreciation can lead to a misstatement of this gain or loss, impacting the income statement. Therefore, a thorough review of accumulated depreciation is necessary prior to asset disposal.

The facets of accumulated depreciation, from its calculation based on the chosen depreciation method to its adjustments and ultimate removal upon asset disposal, are all integral to determining an asset’s worth on financial statements. Accurate tracking and proper application of accounting principles ensure reliable and transparent financial reporting.

3. Depreciation Method

The depreciation method employed exerts a direct and significant influence on asset accounting value. It dictates the pattern in which an asset’s cost is allocated as an expense over its useful life, subsequently affecting accumulated depreciation and, therefore, the resulting accounting value.

- Straight-Line Depreciation

This method allocates an equal amount of depreciation expense each year of the asset’s useful life. This results in a steady decrease in the accounting value over time. For example, a $10,000 asset with a 5-year life and no salvage value will depreciate $2,000 annually. The accounting value decreases by $2,000 each year. This method is suitable for assets that provide consistent benefit over their lifespan.

- Declining Balance Depreciation

This accelerated method recognizes higher depreciation expense in the early years of an asset’s life and lower expense in later years. This results in a more rapid reduction in accounting value initially. A common example is the double-declining balance method, which depreciates an asset at twice the straight-line rate. This is appropriate for assets that lose value more quickly in their early years.

- Units of Production Depreciation

This method allocates depreciation expense based on the actual use or output of the asset. It reflects a more accurate allocation of cost. If a machine is expected to produce 100,000 units and produces 20,000 units in a year, depreciation expense is calculated based on that proportion of total expected output. This directly influences the reduction in accounting value based on asset utilization.

- Choice of Method and Financial Statements

The selection of a depreciation method is influenced by accounting standards, industry practices, and management judgment. The selected method must be consistently applied. Different methods result in varying depreciation expenses, directly impacting profitability reported on the income statement and the asset’s carrying value presented on the balance sheet. The depreciation method should align with the asset’s pattern of use and economic benefit.

The chosen depreciation method fundamentally shapes an asset’s recorded value throughout its operational life. Selection requires careful consideration of asset characteristics and accounting standards. This decision influences both the income statement and balance sheet, impacting financial analysis and investment decisions.

4. Asset's Useful Life

An asset’s expected operational period, known as its useful life, is a crucial determinant in the calculation. This estimated duration directly impacts the depreciation expense recognized each period, subsequently influencing the accounting value. An accurate assessment of useful life is essential for sound financial reporting.

- Impact on Depreciation Expense

The estimated lifespan dictates the period over which an asset’s cost is systematically allocated as depreciation expense. A shorter lifespan results in higher annual depreciation, reducing accounting value at a faster rate. Conversely, a longer lifespan leads to lower annual depreciation, preserving a higher accounting value over an extended period. For instance, a machine with an estimated life of 5 years will incur twice the annual depreciation expense of an identical machine with a 10-year estimated lifespan.

- Influence of Technological Advancements

Rapid technological change can shorten an asset’s effective useful life, even if it remains physically functional. If newer, more efficient equipment becomes available, an existing asset may become economically obsolete, justifying a downward revision of its remaining useful life. This requires recognizing additional depreciation expense to reflect the asset’s diminished value and bringing its accounting value in line with its market value.

- Maintenance and Repair Considerations

The level of maintenance and repairs performed on an asset can influence its actual useful life. Consistent maintenance may extend an asset’s operational period beyond its initial estimate, while neglect may shorten it. Though maintenance costs are expensed, significant overhauls can sometimes extend useful life, necessitating an adjustment to the depreciation schedule and recalculation of the accounting value.

- Subjectivity and Judgment

Estimating useful life involves subjectivity and management judgment, requiring consideration of factors such as past experience with similar assets, industry trends, and anticipated usage patterns. These estimates are subject to change as new information becomes available. Regular reviews of asset lives are necessary to ensure that depreciation expense accurately reflects the asset’s consumption and that the accounting value remains a reasonable approximation of its economic worth.

The asset’s useful life is interconnected with the assessment. It dictates the timeframe over which the asset’s cost is expensed, directly influencing the pace at which the original cost is reduced by accumulated depreciation. An inaccurate or outdated estimate of useful life can distort the accounting value, impacting financial statement analysis and investment decisions.

5. Salvage Value

Salvage value, also known as residual value, is an integral component in determining an asset’s accounting value. It represents the estimated amount an asset can be sold for at the end of its useful life. This projected recovery directly impacts the total depreciable amount and, consequently, the pattern of expense recognition and resulting balance sheet value.

- Determination of Depreciable Base

Salvage value reduces the total cost subject to depreciation. The depreciable base is calculated as the original cost less the estimated salvage value. For example, if an asset costs $100,000 with an anticipated salvage value of $10,000, only $90,000 will be depreciated over its useful life. Ignoring salvage value inflates depreciation expense and understates accounting value during the asset’s operational lifespan.

- Impact on Depreciation Methods

The influence of salvage value varies depending on the depreciation method employed. Under the straight-line method, it directly affects the annual depreciation expense. In contrast, methods like the declining balance method may not explicitly consider salvage value in their calculation, but depreciation ceases when the book value reaches the estimated salvage value. Irrespective of the method, salvage value acts as a floor preventing depreciation below a certain point.

- Subjectivity and Estimation Challenges

Estimating salvage value is inherently subjective and can pose practical challenges. Market conditions, technological advancements, and the asset’s physical condition at the end of its useful life can impact the actual resale value. Organizations must rely on historical data, industry trends, and expert judgment to arrive at a reasonable estimate. Significant errors in salvage value estimation can misrepresent an asset’s true worth on financial statements.

- Accounting for Changes in Salvage Value

If, during an asset’s useful life, there is a significant change in the estimated salvage value, the depreciation expense for the remaining years is adjusted. This prospective adjustment ensures that the remaining depreciable base is allocated over the asset’s remaining life. For example, if an asset’s salvage value increases due to unforeseen market demand, the annual depreciation expense will decrease, resulting in a higher accounting value.

Salvage value plays a crucial role in accurately reflecting an asset’s economic reality on a company’s financial statements. Its estimation requires careful consideration and can significantly impact the recognized worth. A diligent consideration and a thorough understanding are paramount for sound financial reporting and decision-making.

6. Balance Sheet

The balance sheet serves as a financial snapshot, presenting a company’s assets, liabilities, and equity at a specific point in time. The accurate reflection of asset values is paramount, and the accounting value plays a critical role in this presentation. It represents the carrying value of an asset and is prominently displayed within the asset section of the balance sheet. Therefore, understanding how to accurately determine this value is integral to the integrity of the financial statement. A misstatement of asset values on the balance sheet can have cascading effects on financial ratios, investor perceptions, and ultimately, the company’s financial health. For instance, overstated asset values can create a false sense of financial strength, potentially misleading investors and creditors.

The accounting value influences several key financial metrics derived from the balance sheet. The debt-to-asset ratio, a measure of a company’s financial leverage, is directly impacted by the carrying value of assets. A lower asset accounting value increases this ratio, signaling higher financial risk. Similarly, the return on assets (ROA), which measures a company’s profitability relative to its total assets, is affected. An accurate reflection ensures a reliable assessment of a company’s ability to generate earnings from its investments. For example, if a company consistently overstates its asset values through inappropriate depreciation practices, its ROA will be artificially suppressed, potentially deterring investors.

The connection between the balance sheet and the ability to calculate assets worth is fundamental. The balance sheet relies on the accuracy. It allows for a true and fair presentation of a company’s financial position. Challenges in establishing asset accounting values, such as estimating useful lives and salvage values, can introduce subjectivity and potential for manipulation. Therefore, a rigorous and transparent approach to depreciation accounting is essential. The concept is crucial to the reliability of the balance sheet, facilitating informed decision-making by stakeholders and contributing to the overall integrity of the financial reporting process.

Frequently Asked Questions About Asset Accounting Value

The following addresses prevalent queries and misconceptions regarding the calculation of asset accounting value.

Question 1: How often should accumulated depreciation be reviewed?

Accumulated depreciation should be reviewed at least annually during the financial statement preparation process. However, more frequent reviews may be necessary if there have been significant changes in the asset’s usage, technological advancements impacting its value, or alterations to its estimated useful life. Furthermore, an examination should occur before an asset’s disposal to ensure accurate gain or loss calculation.

Question 2: What if there is no salvage value for the equipment?

If an asset is expected to have no value at the end of its useful life, the salvage value is considered to be zero. In this case, the entire original cost of the asset, less any disposal costs, will be depreciated over its useful life. It’s crucial to document the rationale for a zero salvage value to support the depreciation schedule.

Question 3: What happens if an assets fair market value falls below its accounting value?

If there is evidence that an asset’s fair market value has declined significantly below its accounting value, an impairment test should be conducted. If the test confirms impairment, the asset’s accounting value must be written down to its fair market value, resulting in an impairment loss recognized on the income statement. This ensures that the asset is not carried at an amount exceeding its recoverable value.

Question 4: Can the depreciation method be changed once it has been selected?

A change in depreciation method is permissible if the new method more accurately reflects the pattern in which the asset’s economic benefits are consumed. However, such a change should be rare and requires justification. The cumulative effect of the change should be calculated and reported in the period of the change, ensuring transparent financial reporting.

Question 5: Are land improvements, such as fencing and driveways, depreciated?

Land itself is generally not depreciated, as it has an unlimited useful life. However, land improvements, which are enhancements made to the land that have a limited useful life, are depreciated. These include items such as fencing, driveways, landscaping, and irrigation systems. These improvements are subject to depreciation over their respective useful lives.

Question 6: How does the accounting value affect property taxes?

While the accounting value represents the asset’s value on the company’s financial records, property taxes are typically based on the assessed value determined by local tax authorities. The assessed value may differ significantly from the accounting value, as it considers factors such as market conditions and location. It is important to consult with a tax professional to understand the specific regulations in the relevant jurisdiction.

Careful consideration of these questions is essential. An understanding and precise application of established guidelines leads to reliability. These practices are critical in ensuring accurate financial statements.

A recap of the content will follow in the conclusion.

Net Book Value Determination

This exploration detailed the process involved in calculating accounting value. It began with the fundamental componentsoriginal cost, accumulated depreciation, selection of a depreciation method, asset’s useful life, and salvage valueand highlighted their interdependencies. Emphasis was placed on the implications for the balance sheet, emphasizing the critical nature of these metrics for financial analysis.

Accurate understanding and application of these guidelines are essential. Financial professionals must be diligent in their calculations and fully aware of the potential ramifications of errors. Continued adherence to best practices in this domain is crucial for both organizational success and for maintaining confidence in financial reporting.